Plunge Yields: Investors Will Continue to Discount Inflation Data

Fixed income investors would likely continue to heavily discount inflation data due to sustained liquidity in the financial system.

Analysts made the assertion ahead of release of inflation data for August schedule for today by the National Bureau of Statistics calendar.

In the money market yesterday, Chapel Hill Denham said in a report that in line with expectation, inter-bank funding rates eased substantially.

Analysts explained that the drop reflects the impact of a bond coupon payment.

Financial system liquidity opened lower at ₦219 billion from ₦592 billion on Friday, reflecting the impact of provisioning by deposit money banks for the retail FX auction on Friday.

The Open Buy Back and Overnight rate fell by 9.5% and 10.75% to 5.0% and 5.75% respectively.

“We expect money market rates to moderate further in subsequent sessions as liquidity will likely remain buoyant.” Chapel Hill noted.

Two additional bond coupons are expected estimated at about ₦90 billion are expected this week, and a large OMO maturity is scheduled for Thursday (₦350 billion).

Meanwhile, sentiments were bullish in the fixed income market on Monday, thanks to buoyant liquidity and expected inflows in subsequent sessions.

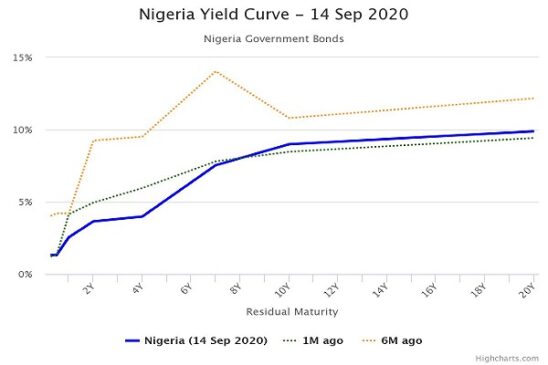

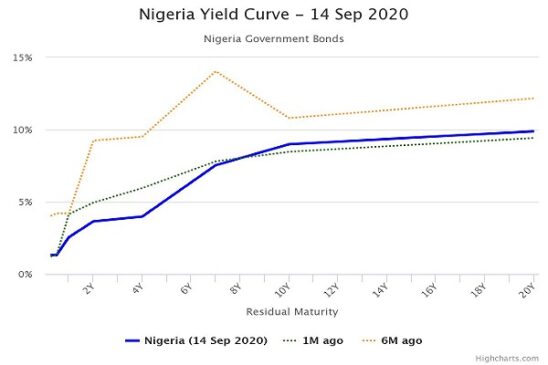

At the front end of the curve, the benchmark Nigerian Treasury Bill (NTB) curve was unchanged at an average of 1.73%.

Also, the OMO curve compressed by 24 basis points (bps) to 2.39%.

In the bond market, Chapel Hill said the bullish sentiment was broad-based, as yields compressed across benchmark tenors by an average of 10bps to 7.26%: the short (-10bps to 4.11%), intermediate (-16bps to 7.79%) and long (-4bps to 9.77%) term bonds.

The NBS is scheduled to publish August Consumers Price Index report on Tuesday September 15, 2020.

Read Also: Price Instability: CBN Estimates 14.15% Inflation Rate for 2020

“We estimate a higher inflation print – 12.94% from 12.82% year on year in July – driven by higher food and fuel prices.

“Even as inflation expectation remains elevated, investors are likely to continue to heavily discount inflation data, given that liquidity factors have become the preeminent drivers of returns”, Chapel Hill Denham explained.

In a related development, pressures persisted in the parallel market as the USD to Naira ask rate depreciated by another ₦5 or 1.1% to 460.00.

Analysts said liquidity challenges remain in the FX market despite the recent intervention by the CBN in the BDC segment.

In the I&E Window, the local currency continues to trade within a tight band, and closed flat at ₦386.00.

The official and secondary market intervention sales (SMIS) rates were unchanged at ₦379.00 and ₦380.69 respectively.

Plunge Yields: Investors Will Continue to Discount Inflation Data