FBNH Plc.’s Beautiful Turnaround Drives Numbers Upgrade

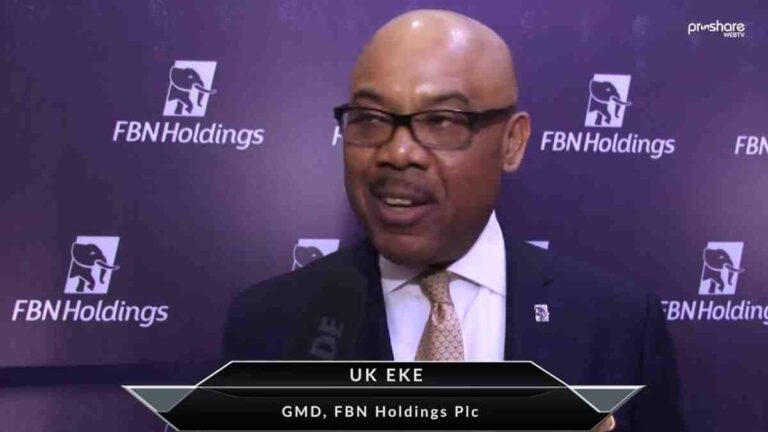

FBN Holdings (FBNH) Plc. earned equity analysts buy rating as financial services boutique’s beautiful turnaround strengthen its balance sheet quality and earnings profile.

In its financial year result for 2020, FBN Holdings was able to deliver an impressive performance amidst pandemic-induced economic stress and increased regulatory costs.

The better-than-expected result was driven by non-interest revenue as earnings from interest yielding assets were affected by low interest rate environment.

Electronic and agency banking

The group recorded impressive growth across its e-banking channels, with both transaction volumes on USSD and mobile banking increasing by 28% and 43% year on year, respectively.

Although, e-banking revenue grew slightly by 1.3%, which management alluded to the negative impact of the CBN’s reduction in fee charges in early 2020.

FBH Holdings agency banking network continued to expand, with the number of agents doubling year on year to about 100,000, with transaction volumes and value up 162% and 215%, respectively, to 479 million and NGN10 trillion.

Analysts at Tellimer said the next phase for growth in the group’s agency banking network is expansion into other African countries through its subsidiaries, particularly in Ghana, Democratic Republic of Congo and Guinea.

Analysts Ratings

In its equity report, analysts at ARM Securities Limited appear to have decided to bet large of FBN Holdings stock with strong buy rating while they away numbers adjustment.

Similarly, Analysts at Chapel Hill Denham also maintain BUY rating on FBNH with a 12 month target price of N9.95, after noting that the bank maintained consistent dividend payments over the years and its efforts at cleaning up its loan book.

Likewise, Tellimer analyst Busola Jeje said the investment firm has a Buy rating on FBNH, with an unchanged 12 month target price of NGN10.7, which translates to an expected total return above 50%.

Just like others, equity analysts at Meristem Securities sets target price of NGN9.02 for FBN Holdings stock using its price earnings of 3.16x and expected earnings per share of N2.85 as basis for the estimate.

Mixed Topline Performance

In line with industry trend, FBN Holding 2020 financial scorecard was supported mainly by non-interest income. Of which analysts noted the bank efforts to deliver services to customers during economic lockdown.

Meristem Securities said higher transaction volumes from its enlarged agency and digital platforms, increased credit related fees, as well as elevated prices of investment securities.

Noting that these were instrumental in providing respite for gross earnings, which dipped marginally by 1.92% to NGN578.95 billion.

“We highlight the impressive growth (+45.87%) of trading gains, credit related fees and E-banking fees, which now constitute about 75% of total non-interest income.

On the other hand, analysts explained that 10.9% year on year reduction in interest income, on the back of low yield on investment securities, was the source of the drag in topline.

“Our outlook for interest income is positive, fueled by the upward repricing of yields on investment securities”, Meristem Securities added.

Yields on securities is gathering momentum in the fixed income market, consensus estimate indicates that this will be earnings positive for Nigerians banks.

“We think that management’s intention to replicate the agent banking strategy in other African subsidiaries would support transaction volumes and potentially sustain non-interest income growth.

“However, we do not expect much from trading gains in 2021, given that the factors which contributed to its strong performance in 2020 are beginning to reverse”, Meristem analysts detailed.

Higher Profitability

Of a note was the fact that the FBN Holdings Plc. was able to stay afloat despite higher regulatory cost amidst worsening economic condition in the pandemic year. While general business atmosphere was clouded, regulatory charges were still heavy on income statement.

In the result, analysts spotted a further decline in cost of funds by about 80 basis points year on year to 2.30%, which benefitted from the improvement in current and savings account (CASA) mix and reduction of interest on savings deposits.

However, equity analysts hinted that this partially offset the significant drop in asset yield of about 210 basis points year on year to 9.40%, as net interest margin (NIM) slowed to 6.10% from 7.40% in 2019.

Analysts said they were pleased to see that the bank reported only a marginal increase in operating expenses, rising +0.45% year on year, despite inflationary pressures.

For the whole of 2020, Nigeria’s headline inflation maintained an upward trend, which put pressure on operating expenses across the industry.

Moreover, analysts stated that elevated regulatory cost which increased by +16.32% year on year was the primary source of the increase in expenses.

Operating income, on the other hand, expanded +2.23% year on year, as a result of lower interest and fee related expenses in the year. This translated into a decline in cost-to-income ratio by 122.80 bps to 69.20%.

Meanwhile, analysts at Meristem Securities said they noted that nonrecurring gains from the disposal of the insurance subsidiary supported bottom-line.

Also (and against industry trend), lower impairment charges during the year had a trickle-down effect to elevate profit after tax (PAT), which recorded a +21.81% growth to NGN89.73 billion.

“We anticipate a sustained improvement in the bank’s CASA mix, aided by the deepening of its agent banking footprint, which should keep funding costs subdued”, analysts said.

Also, Meristem Securities maintained that the uptrend in yield on investment securities is expected to bode well for asset yield.

Therefore, the firm’s expectation is that FBNH net interest margin will expand in 2021. In addition, analysts projected a further reduction of impairment charges, which would have a pass-through effect to bottom line.

Ultimately, for financial year 2021, the investment firm projected a 17.72% growth in FBNH profit after tax expenses to NGN105.63 billion.

Asset Quality Strengthened

After FBNH Balance sheet repair program, lender’s assets quality has improved significantly. And this has supported its lower impairment charge against income statement. Which actually acted as a buffer in the pandemic year, giving support to its bottom line.

“We like the sustained turnaround in the bank’s asset quality, though we acknowledge that there is still room for improvement”, Meristem Securities stated.

It added that with limited exposure to sectors most affected by the pandemic (Hospitality and Aviation), a restructuring of about 15% of its loan book and write-off of NGN60.24 billion impaired loans, the group’s Non-Performing Loan (NPL) ratio reduced to 8.39% from 10.20% in 2019.

Similarly, stage 2 loans reduced to 23.52% of gross loans from 35.24% the previous year.

Also, FBNH capital adequacy ratio strengthened to 17.01%, from 15.45% in 2019 following capital injection from proceeds of sale of the group’s insurance subsidiary.

“With a substantially higher effective cash reserve ratio at 27.02% from 20.98% in 2019, the bank’s liquidity ratio came in lower at 34.80% from 38.20%, although still above regulatory minimum.

Police Neutralise 3 Bandits, Recover 330 Stolen Animals in Katsina State…

Meristem Securities sets target price if NGN9.02 for FBNH stock from its price earnings of 3.16x and expected earnings per share of N2.85.

FBNH Plc.’s Beautiful Turnaround Drives Numbers Upgrade