CBN’s Dilemma: Between Naira Devaluation and Ineffective FX Policy

Nigeria’s multi-tiered foreign exchange policy has proven to be ineffective to manage the local currency with multiple variables working against it in the currencies markets.

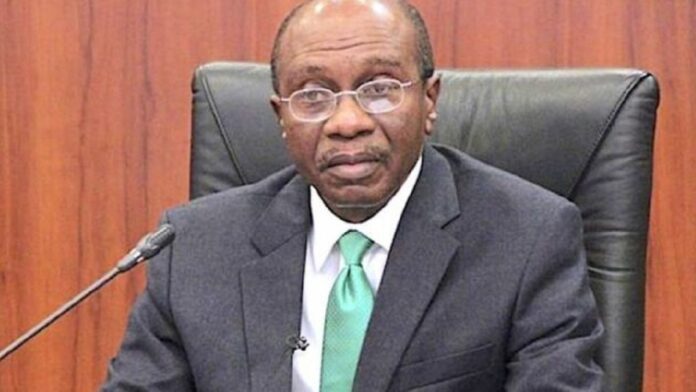

Naira has lost significant value, from N197 to a United States dollar in 2015 to N431.50 at the Investors and Exporters FX window on Friday. The apex bank has insisted on market intervention to curb the naira from falling but that which Godwin Emefiele’s led CBN dread most keeps happening.

The question remains: should the naira be allowed to trade freely in the foreign exchange markets? It is an unlikely gesture for an economy that feeds millions of people with imported goods and services.

Allowing the forces of demand and supply to determine the Nigerian naira exchange rate is a road to becoming the Zimbabwe dollar – the locals would need as much to buy a loaf of bread.

However, the Nigerian naira has been under pressure but there is no respite in sight over the lack of foreign investors in the local economy amidst changing global market dynamics. Money, economists say, goes to where it is treated well but not currently in Africa’s largest economy where financial repression is still at play.

Nigeria’s consumer price level is steeply above average return in the financial market, some analysts had expressed that government is borrowing from the local debt capital market at a rate below inflation prints.

It is sufficient to say the low-interest rate era has near its final end after two times interest rate hikes by the monetary authority. While benchmark interest rate hikes have been lifted to 14% from 11.50% in March, hot monies in the local economy have shrunk.

Mid-year 2022, MSCI Index issued a warning to downgrade Nigeria’s Indexes, citing an inability of foreign investors to get dollars out of the country. Some multinationals operating in the local economy are battling the Central Bank of Nigeria’s capital control measures.

Naira must not be left alone to the interplay of demand and supply, some analysts agreed. However, large numbers of Broadstreet experts want the local currency to be devalued, saying the local currency is heavily overpriced.

Currency inflation matched naira purchasing power in the local market, with food items prices skyrocketing – and it is in autopilot mode. Headline inflation could kiss 20% before year-end, MarketForces Africa gathered from Nigerian economists who preferred not to be quoted.

.Recently, some foreign airlines announced a decision to halt flights over the Central Bank of Nigeria’s capital control measures which resulted in funds being tied down in the local economy.

In the second quarter of 2022, foreign currency inflows into the nation went down, according to the National Bureau of Statistics (NBS). The Bureau’s capital importation report shows a 2.4% quarter-on-quarter drop to $1.54 billion between the first and second quarter of 2022.

In the first quarter of 2022, Africa’s largest economy achieved a foreign currencies inflow worth $1.57 billion, a level that economists considered significantly low when compared to Nigeria’s $450 billion gross domestic size.

“We believe the persistent slowdown in capital importation reflects foreign investors’ lacklustre interest in the country given uninspiring macro narrative, relatively lower yields on fixed income instruments and OMO bills compared to historical trends and lingering FX liquidity constraints”, Cordros Capital said in a note.

NBS’s breakdown showed that foreign portfolio investment dipped 20.9% in the second quarter of 2022 to $757.32 million and foreign direct investment was 5.0% lower in the second quarter to $147.16 million. Analysts said these were enough to outweigh the increase in other investments which surged 37.0% in the second quarter to $630.87 million.

However, on a year-on-year basis, capital importation rose by 75.3%, primarily driven by a low statistical base effect from the corresponding period of 2021, according to data from the Bureau.

“We maintain our expectation that foreign inflows would remain low compared to pre-COVID levels over the medium term, given a plethora of factors, including the lack of flexibility in the FX framework, inadequate structural reforms, and election uncertainties”, Cordros Capital analysts said in its commentary note.

Foreign Inflow remains low, totalling $3.11 billion. In the first half of 2022, the country’s total value of capital importation in the second quarter of the year stood at $1.54 billion, from $875.62 million in the corresponding quarter of 2021, showing an increase of 75.34%.

However, this is 2.40% lower than the $1.57 billion received in the preceding quarter. Cumulatively, a total of $3.11 billion has been recorded as imported capital in the first half of the year.

A breakdown of the report revealed that the largest amount of capital importation into the country was received through the Foreign Portfolio Investment (FPI) which stood at $757.32 million and accounted for 49.33% of the total inflows.

It was trailed by Other Investments with 41.09% ($630.87 million), and Foreign Direct Investment (FDI) accounted for 9.58% ($147.16 million) of total capital imported in the second quarter of the year.

FDI increased by 82.3% year on year from $77.97 million recorded in the second quarter of 2021 to $147.16 million. Likewise, FPI recorded a 37.4% increase to $757.32 million in Q2-2022 but declined by 20.9% quarter on quarter from $957.58 million in the preceding quarter.

#CBN’s Dilemma: Between Naira Devaluation and Ineffective FX Policy#